Equity Markets

Growth comes roaring back!

As the summer comes to an end, we are reminded once again the old adage “sell in May and go away” does not always hold true for the broad US stock market. Although summer is not technically over until September 22, the S&P 500 return was 8.8% from May 1st to August 30th. During this period, as measured by the S&P 500 Growth & Value Indexes, we saw returns of 13.5% and 3.8% respectively. Clearly, investors favored Growth over Value this summer. Contrast that with the first four months of 2021 when Value (SVX) returned 14.9% vs. 9% for Growth (SGX).

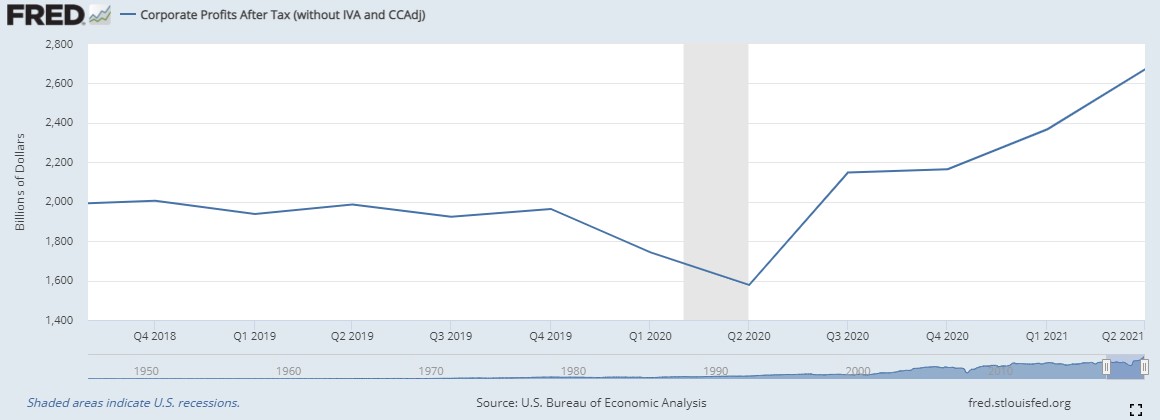

Whether you prefer Growth or Value, what we find remarkable is after a 20% return in the S&P 500 in 2020, the index is up another 21% year to date. Why such strong results during a time of economic uncertainty? The productivity boom of 2020 is driving sustained, strong corporate earnings, and profit margin expansion. In the chart below, the St. Louis Fed records corporate profits after taxes. As you can see, profits are higher today than their pre-Covid levels.

SOURCE: https://fred.stlouisfed.org/graph/?g=GDFQ

Lightning Round – A quick take on popular investment topics:

Cryptocurrencies – The cryptocurrency market has been compared to the “Wild West”, where growth, innovation, and fraud have flourished in a largely unregulated $2 trillion market. Now, politicians and regulators are circling the wagons around the industry. With Congress and SEC looking to bring more transparency and frameworks into the crypto world, it will be very interesting to see what approaches central authorities take to balance investor protection with industry stability & growth. Meanwhile, El Salvador has embarked on a first in the crypto & monetary world; the first country to accept Bitcoin as legal tender. Time will tell if they are a monetary avant-garde.

“Buy the dip” – China is on sale– Chinese regulation fears have shrunk valuation levels on popular Chinese stocks traded in the US, such as Baba, Bilibili, & NIO, and many other companies with strong business fundamentals. Large downward moves in price have driven many less committed investors to the sidelines. In our opinion, for patient investors with a long-term perspective, this presents an opportunity for value as we believe China’s moves will improve the country’s capital markets and governance.

Cannabis – Cannabis stocks rallied to start the year on hopes of federal legalization, but these legalization efforts have since stalled. Despite government inaction, the industry is set to expand further as more and more states clear recreational cannabis use. The fundamentals of US Multistate Operators (MSOs) remain strong as they continue to grow revenues and profits regardless of federal support.

Fixed Income Markets

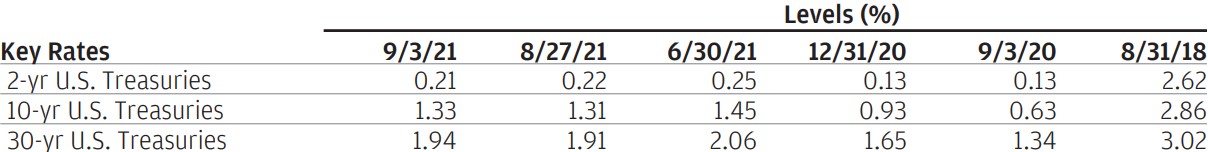

Treasury Current Yields:

SOURCE: https://am.jpmorgan.com/content/dam/jpm-am-aem/global/en/insights/market-insights/weekly-market-recap-us.pdf

Green and Social Bonds – Using debt capital markets to fund climate and community solutions

Green bonds were created to fund projects that have positive environmental and/or climate benefits. The majority of green bonds issued are “use of proceeds” or asset-linked bonds. Proceeds from these bonds are earmarked for green projects but are backed by the issuer’s entire balance sheet. Such projects could be for the prevention of climate change by reducing emissions of greenhouse gases, increasing energy efficiency, or improving waste management. The concept of green bonds is relatively new.

Traditional bonds vs green bonds

Generally, when a company sells bonds, it states a reason for raising funds such as general company purpose. These funds could be used to buy back its own shares, pay dividends, or even pay back some other outstanding debt. But green bonds are different. To qualify as a legitimate green bond, the issuer is expected to meet certain conditions which are globally known as Green Bond Framework.

Accordingly, the company should indicate clearly which environmental issues the bond proceeds address. It has to say what are the non-monetary techniques used for project evaluation and selection to meet the environmental issues declared. The company must explain in detail about managing the proceeds, and document in a detailed manner the metrics used to measure the impact of the projects, such as how much greenhouse gas emissions are expected to be reduced and how this will be communicated to investors.

Investors should consider green bonds as part of their portfolio because this type of bond carries lower risk than other bonds. The salient feature of green bonds is that the proceeds are raised for a declared green project, repayment is tied to the issuing company and not the success or failure of the projects. Thus, the onus of payment of interest and principal lies with the issuing company and is not based on the performance of the project.

From the issuer’s perspective, green bonds offer a chance to demonstrate their concern for the environment. The issuer company attracts a certain set of investors from the global market who have earmarked funds for such green ventures and thus the interest rate on such bonds are relatively lower than traditional bonds.

Your content goes here. Edit or remove this text inline or in the module Content settings. You can also style every aspect of this content in the module Design settings and even apply custom CSS to this text in the module Advanced settings.

Featured Bond: Wells Fargo & Co.

Wells Fargo (NYSE: WFC) Wells Fargo & Co. is an American multinational financial services company with corporate headquarters in San Francisco, California, operational headquarters in Manhattan, and managerial offices throughout the United States and internationally.

Wells Fargo 4 year non-callable inaugural ESG-related (Environmental, Social, and Governance) bond offering:

Use of proceeds for the sustainability bond is earmarked for inclusive communities and climate projects. Like Green Bonds, Social Bonds aim to finance or refinance projects with an identified social objective. Their financial characteristics are similar to traditional bonds and they provide a social return, making them an attractive financing tool. Social Bonds meet the principles of socially responsible investment.

Global ESG assets in all classes are on track to exceed $53 trillion by 2025, representing more than a third of the $140.5 trillion in projected total assets under management. A perfect storm created by the pandemic and the green recovery in the U.S., EU, and China will likely reveal how ESG can help assess a new set of financial risks and harness capital markets.

Disclaimer: Yields & Availability are subject to change

Avitas Wealth Making Headlines

At Avitas Wealth we strive for excellence. We are pleased to receive recognition from our clients and partners. Over the course of the last year, Avitas has also received awards and recognition for our work with clients, our firm management, oversight, culture, and contributions to our community. Below are our three most recent accolades.

Financial Advisor Magazine – 2021 RIA Survey & Ranking

-

-

- Each year FA Magazine reviews the largest Registered Investment Advisors (RIA’s) in the nation recording each one by their size and year over year growth. Click here for additional details.

-

Los Angeles Business Journal – Leaders of Influence: Wealth Managers

-

-

- There are some truly outstanding professionals making up the Los Angeles wealth management landscape. Congratulations to Catherine Gerst, Eric Taslitz, and Scott Duncanson for your contributions to the local economy and the financial stability of the individuals and families that live here. Click here for additional details.

-

ThinkAdvisor – Luminaries Class of 2021: Thought Leadership

-

-

- We are pleased to receive the first Thought Leadership & Education winners in the new, pioneering recognition program: the LUMINARIES created by ThinkAdvisor. Members of the Class of 2021 are being honored for the dynamic efforts that are driving the financial services industry forward. Members of the Class of 2021 LUMINARIES were selected by a distinguished and diverse panel of judges from across the advice industry, as well as by our editorial team. Click here for additional details.

-

Avitas Wealth Management, LLC (“Avitas”) is an SEC registered investment adviser located in Los Angeles, California. Avitas and its representatives are in compliance with the current registration and notice filing requirements imposed upon SEC registered investment advisers by those states in which Avitas maintains clients. Avitas may only transact business in those states in which it is registered, notice filed, or qualifies for an exemption or exclusion from registration or notice filing requirements. Avitas’s web site is limited to the dissemination of general information regarding its investment advisory services to United States residents residing in states where providing such information is not prohibited by applicable law. Accordingly, the publication of Avitas’s web site on the Internet should not be construed by any consumer and/or prospective client as Avitas’s solicitation to effect, or attempt to effect transactions in securities, or the rendering of personalized investment advice for compensation, over the Internet. Furthermore, information on this Internet site should not be construed, in any manner whatsoever, as the receipt of, or a substitute for, personalized individual advice from Avitas. For information pertaining to the registration status of Avitas, please see the Investment Adviser Public Disclosure website at http://www.avitaswealth.com. A copy of Avitas’s current written disclosure statement discussing Avitas’s business operations, services, and fees is available from Avitas upon written request. Avitas does not make any representations as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to Avitas’s web site or incorporated herein, and takes no responsibility therefore. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly.

ACCESS TO THIS WEBSITE IS PROVIDED FOR INFORMATIONAL PURPOSES ONLY AND WITHOUT ANY WARRANTIES, EXPRESSED OR IMPLIED, REGARDING THE ACCURACY, COMPLETENESS, TIMELINESS, OR RESULTS OBTAINED FROM ANY INFORMATION POSTED ON THIS WEB SITE OR ANY THIRD PARTY WEB SITE LINKED TO THIS WEB SITE.