Want a Lower Mortgage Rate? Take Someone Else’s Loan

Dave and Melissa Hostetler considered cutting the list price again on their Rockville, Md., home in June. Instead they decided to dangle another goody before prospective buyers: their low-rate mortgage could come with the house.

Dave and Melissa Hostetler considered cutting the list price again on their Rockville, Md., home in June. Instead they decided to dangle another goody before prospective buyers: their low-rate mortgage could come with the house.

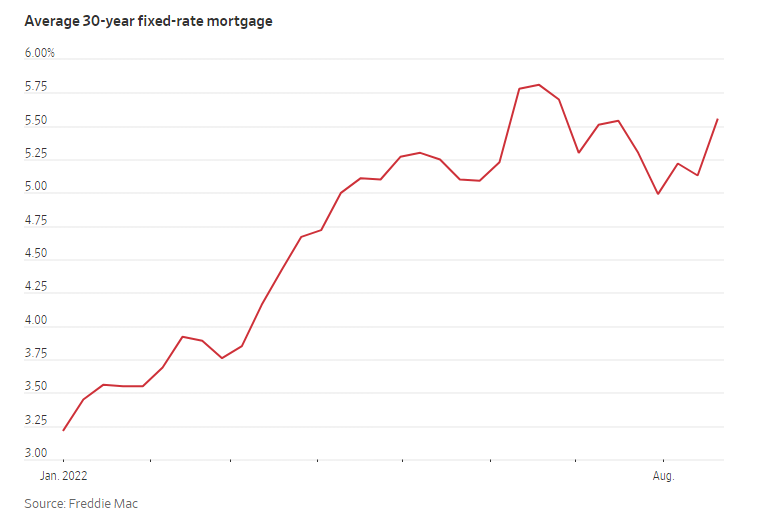

Mortgage assumption, as the practice is known, is garnering attention for the first time in years. It is typically allowed in government-backed mortgages like the Department of Veterans Affairs program the Hostetlers used when they bought their house in 2019. Offering up an old mortgage can make a house more affordable, saving buyers hundreds of dollars a month compared with market rates north of 5%.

“We came on the market a week or two after interest rates had spiked,” Mr. Hostetler said. “We missed the market in timing.”

A prospective buyer who had already toured the house decided that taking on the 3.375% interest rate on their 30-year fixed VA loan sweetened the deal. The four-bed, three-bath house sold for the $834,000 asking price last month.

Higher interest rates are prompting many home buyers to seek alternative ways to lower their mortgage costs. Some are using bigger down payments or turning to adjustable-rate mortgages that offer a lower rate for the first few years. Mortgage assumptions aren’t common, but there has been more interest lately, say lenders, real-estate agents and government officials.

In a standard home sale, a buyer takes out a mortgage at going rates to pay the seller. The seller uses the money to pay off their own mortgage and pockets the rest of the cash.

An assumable transaction is different because it doesn’t replace an old mortgage with a new one, but instead transfers the old mortgage to the new owner. The seller is relieved of the remaining mortgage liability, so the balance gets subtracted from the purchase amount owed to them. The buyer must come up with cash to cover the difference.

That difference can be substantial if the seller has paid off a big chunk of their mortgage or the home’s value has jumped, so a buyer may need a large down payment or a second mortgage, which would almost certainly have a higher rate. That, as well as the sometimes restrictive and bureaucratic nature of loan assumption, means the option isn’t viable for many buyers.

“While the interest may be spiking, I don’t know how much ultimately we will see in the number of assumptions,” said Chris Birk, vice president of mortgage insight at Veterans United Home Loans, the largest VA lender. He said the company had done seven assumptions since 2020, compared with more than 170,000 purchase loans.

A spokesman for the VA said the agency has recently received more inquiries about loan assumptions. A spokeswoman for the Department of Housing and Urban Development said the agency expects more borrowers to explore the assumability option in its Federal Housing Administration loan program, but it is too early to know how many assumptions will happen.

A recent search on Zillow Group Inc. turned up hundreds of listings that tout assumable loans. They are typically referenced in property descriptions next to details about wainscoting, subzero refrigerators and en-suite bathrooms.

The listings are catching the eye of buyers like Tom Slattery, an officer in the Coast Guard, who browsed Zillow and other sites every day this summer with his wife for houses with assumable loans. They recently went into contract on an Alexandria, Va., property and they are taking the seller’s 2.75% VA loan. He guesses it will knock more than a quarter off their monthly costs.

“We were just pretty ecstatic to realize that we could get a home that would have been at the tippity top of our budget and now we can be in there more comfortably,” he said.

The universe of potentially assumable loans is large, given that government-backed loans account for about a fifth of the $14 trillion-plus in mortgage originations in the past half decade, according to industry research group Inside Mortgage Finance.

But loan assumptions don’t pan out for many transactions. Richard Pearrell, the real-estate agent at eXp Realty who sold the Hostetlers’s house, said he also worked with another seller recently who had a VA loan, but the balance was about 25% of the asking price, too small to make the assumability feature worth it to a typical buyer.

Everything aligned for the Hostetlers. The loan balance was roughly 80% of the purchase price, and the buyer had been planning to use a substantial down payment anyway. Because Mr. Hostetler is a military veteran, he is eligible for the VA loan program and he had used it a handful of times, most recently when he refinanced in 2020 as rates were falling.

The buyer isn’t a veteran, but the program’s guidelines allow a civilian to take over the loan using the seller’s entitlement to the program. That means Mr. Hostetler will have limitations on taking a new VA loan until this one is fully paid off. Mr. and Mrs. Hostetler and their daughter recently relocated to the Austin, Texas, area, but didn’t use a VA loan for the home they purchased there.

Both sides of the transaction had to go through the lender’s manual approval process for loan assumptions, Mr. Hostetler said. They made the sale contingent on the lender, U.S. Bancorp, approving the loan assumption, but managed to get the green light in time for closing.

A spokesman for U.S. Bancorp said the lender currently has three times its normal volume of assumptions.

The buyer must pay a funding fee of 0.5% of the value of the loan to the VA upon assumption of a VA loan. The seller must obtain a release of liability from the lender to avoid remaining on the hook for the loan.

“No one had done these in years, so it was new to everyone in the transaction,” said Adam Isaacson, vice president at TTR Sotheby’s International Realty, one of the buyer’s real-estate agents. “We were all learning as you go.”

See the full article here.

By Ben Eisen

Published August 28, 2022