Investor Update

Private Equity Access 2019, LP

The Private Equity Access 2019, LP Partners Capital Account Statement (PCAP) through December 2021 is available.

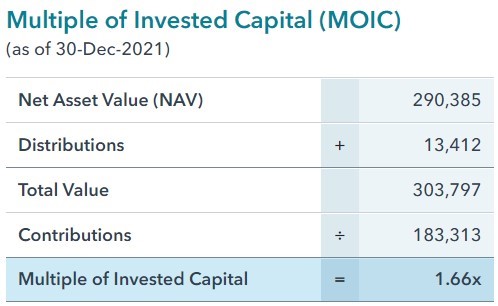

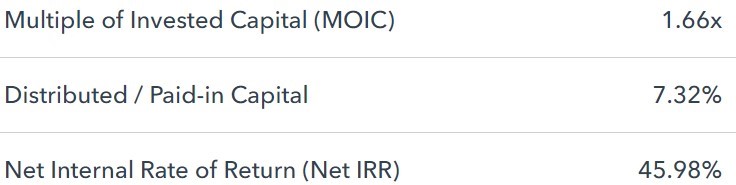

Through the end of 2021, the Fund’s Multiple of Invested Capital (MOIC) is 1.66x with a 45.98% Net IRR. Below is a snapshot based on a $250,000 commitment.

Through March 2022, the Access fund has called approximately 72% of the capital commitment.

All four underlying fund managers have provided investment highlights below.

Coatue Growth Fund IV

Coatue Growth IV (GFIV) is a global investment manager providing growth capital to technology, media and telecommunications companies they believe have substantial market opportunities.

Coatue Growth Fund IV had committed capital of $3.6 billion of which was 99% invested. As of December 2021 the fund had an approximate value of 11.25 billion, of which, $1.1 billion was realized and $2.7 billion public. The remaining $7.4 billion of value was private and unrealized. The Fund’s IRR was 102%.

For the quarter ending December 31, 2021, GFIV invested approximately $99 million into existing portfolio follow-ons: Gorillas ($28.6 million), Stytch ($13 million), Impossible Foods ($11.5 million), Melio ($10.5 million), Deliverr ($10 million), Inxeption ($10 million), Vedantu ($10 million), and Cato Networks ($5.3 million)

Polaris Partner Fund IX

Polaris Partners has a 20+ year history of partnering with repeat entrepreneurs and world-class innovators who are improving the way we live and work. The multi-billion dollar firm invests in exceptional healthcare and technology companies across all stages, from founding to profitable growth.

As of March 31, 2022, the Fund has called $244.2 million from its limited partners, representing 61% of committed capital. As of March 31, 2022, there were forty-six active companies in the portfolio with a cost of $257 million and a value of $379 million. On February 8th, Sanofi acquired Amunix Pharmaceuticals for approximately $1 billion and up to $225 million in potential milestone payments. The Fund received closing consideration of $39 million with additional consideration of $2 million (milestone and escrow), representing a gross IRR and gross multiple of 119.9% and 4.1x respectively.

Marathon Asset Management Fund

Marathon Asset Management seeks attractive total returns through investments in the global credit markets and real estate related markets with a long-term goal of building a world-class asset management platform. Marathon’s team has significant experience investing in credit dislocations through multiple cycles.

Marathon Distressed Credit Fund (MDCF) made several single-name Distressed and Dislocated Credit investments they believe offer attractive return profiles through bankruptcy, restructuring, or refinancing. Marathon has called approximately 46% of our capital commitment. From inception through December of 2021, the Fund is reporting 45.44% IRR and 1.31X Net MOIC.

Egis Capital Partners Fund III

Egis Capital Partners makes control-oriented buyout and growth investments in technology-driven businesses in the Security and Protection industry. Egis is focused on partnering with companies that can benefit from their industry knowledge, operational and financial expertise, C-level relationships, and proactive ownership model.

Three portfolio companies, Mission Critical Partners (“MCP”), ClearObject (“CO”), and ButterflyMX (“BMX”) had strong first quarters, meeting or beating most of their financial and operating objectives.

Series A/B & A/C

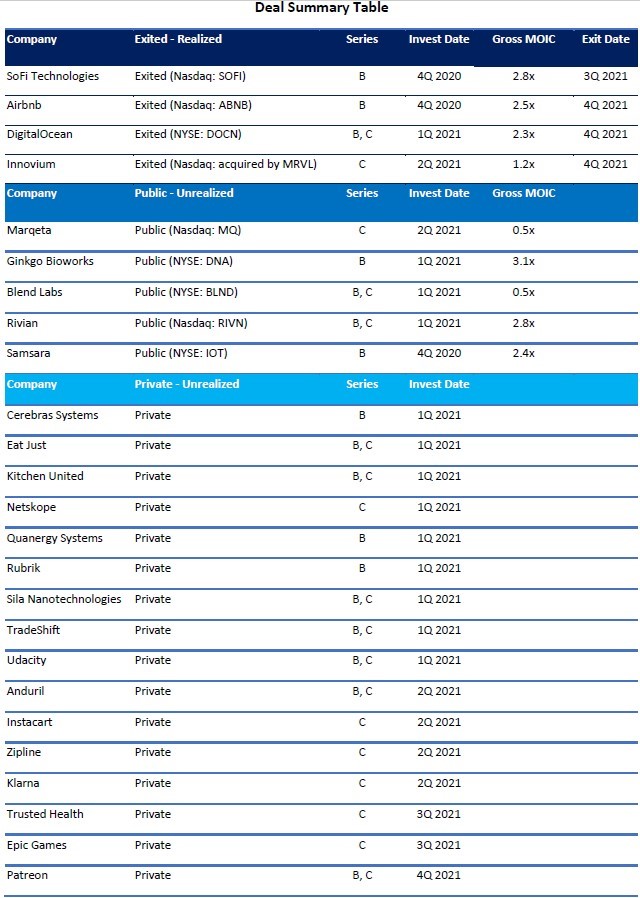

Investments in the B & C Series as of December 31, 2021, are detailed below.

Of the twenty-five investments made since inception: nine are trading publicly, four have been fully realized, and sixteen are private and unrealized.

*A “qualified purchaser” as defined by the SEC National Securities Markets Improvement Act of 1996 section 3(c)(7) to the Investment Company Act is an individual or a family-owned business that owns $5 million or more in investments. The term “investments” shouldn’t include a primary residence or any property used for business. Notice the benchmark for a qualified purchaser is investments rather than net assets, which is a standard you may be used to seeing for investor accreditation. The term “investments” is fairly broad here and includes stocks, bonds, futures contracts, cash and cash equivalents, commodity futures contract, real estate, financial contracts and other alternative assets held for investment purposes. Other qualified purchaser categories include:

-

an individual or entity (for example, a fund manager) that invests at least $25 million in private capital, on its own account or behalf of other qualified purchasers;

-

a trust sponsored and managed by qualified purchasers; or

-

an entity owned entirely by qualified purchasers.

The information contained herein is for informational and discussion purposes only, and may not be relied on in any manner as investment advice, a recommendation or opinion regarding the appropriateness or suitability of any investment or strategy, or as an offer to sell or a solicitation of an offer to buy an interest in the Fund.