Investment Strategies

Investment Philosophy

At AWM, our investment philosophy is to simplify the investment process by managing assets directly, removing intermediaries, minimizing client fees & ensuring accountability.

Investment PRINCIPLES:

- Diversification to monitor and manage risk

- Avoid fads, manias, and short-term thinking

- Invest in the same strategies as our clients

How We Manage Your Money

At Avitas Wealth Management we do not outsource portfolio management. We are the portfolio managers. Through our four equity strategies and three fixed income strategies, our client’s assets are managed in-house by our asset management team with an eye towards risk management, relative performance and accountability.

Individual Account Management

Accounts are managed separately; clients own each stock and bond in the portfolio to provide customized strategic decisions.

Experience

Our seasoned equity and fixed income managers have 20+ years of portfolio management experience.

Extensive Resources

We have deep relationships with multiple trading desks and research sources across the industry.

Business & Industry Innovation Monitoring

Seek out new, leading companies with disruptive technologies, services and business models.

Tax Optimization

Tax sensitive portfolio management is a priority.

No Intermediaries

Direct asset management means no intermediaries and less fee layering.

Accountability & Monitoring

As your portfolio managers we are accountable. Wherever you are in the world you can be assured we are managing your assets.

Fixed Income Management 1,2,3

#1 protect your assets, #2 avoid interest rate risk, #3 invest for a reasonable yield.

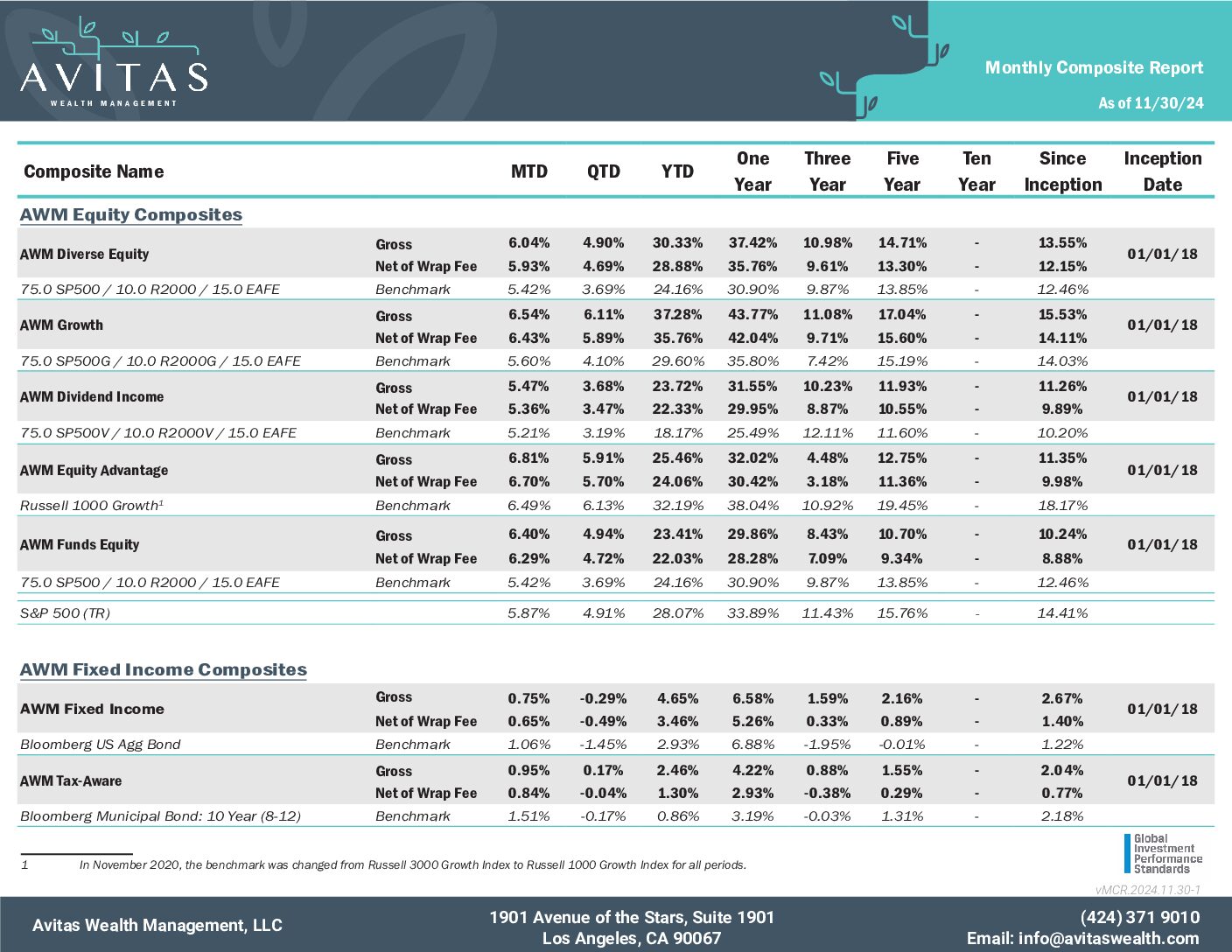

Annual Performance & Disclosure Information

AWM Equity Strategies

AWM Growth Strategy

- AWM Growth is a global, multi-cap strategy that invests primarily in publicly traded stocks selected for their growth characteristics.

- The strategy invests primarily equities believed to have significant potential for capital appreciation due to the business characteristics of the company

- Less emphasis is placed on a traditional “Value approach”.

AWM Equity Advantage Strategy

- An aggressive growth strategy most often seeking companies with new technologies, new markets and disruptive business models and utilizes option trading strategies.

AWM Dividend Income Strategy

- AWM Dividend Income is a global, multi-cap strategy that invests primarily in publicly traded stocks selected for their relative value and dividend-paying and characteristics.

- A focus on capital appreciation and dividend income, the AWM Dividend Income strategy looks to invest in companies that are under-valued relative to their industry peers.

- Less emphasis is placed on a traditional “growth approach”.

AWM Diverse Equity Strategy

- AWM Diverse Equity Strategy is a managed blend of the AWM Growth Strategy and the AWM Dividend Income Strategy and provides a “Core” equity portfolio.

Avitas Fixed Income Strategies

AWM Tax-Aware

- Invests primarily in individual, tax-free municipal bonds.

AWM Taxable

Invest primarily in individual, investment grade corporate bonds of US domiciled companies.

Avitas Wealth & GIPS® Compliance

Avitas Wealth claims compliance with the Global Investment Performance Standards (GIPS®).

- These are a set of ethical principles that guide how to calculate and present investment results.

- Although voluntary, the Standards have been widely adopted by institutional asset managers.

- An outside auditor reviews Avitas’ efforts to comply with the GIPS®standards each year.

Equity Composite Performance Reports

Fixed Income Composite Performance Reports

Balanced Composite Performance Reports

- Diverse Equity 70%

Fixed Income 30% Composite (2023) - Diverse Equity 50%

Fixed Income 50% Composite (2023) - Diverse Equity 30%

Fixed Income 70% Composite (2023) - Funds Equity 70%

Fixed Income 30% Composite (2023) - Funds Equity 50%

Fixed Income 50% Composite (2023) - Funds Equity 30%

Fixed Income 70% Composite (2023)

Our Office

1901 Avenue of the Stars, Suite 1901

Los Angeles, CA 90067